are political contributions tax deductible for a business

If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. According to the IRS Most personal political contributions are not tax deductible.

Are Political Donations Tax Deductible Picnic Tax

These business contributions to the political organizations are not tax-deductible just like the individual.

. The IRS makes it clear that you cannot deduct contributions that you make to any organizations that arent qualified to. If youre self-employed however you can deduct the cost of any supplies or services you donate to a. Limits on Political Contributions.

Your business cant deduct political contributions donations or payments on your tax return. The IRS is very clear that money contributed to a politician or political party cant be deducted from your taxes. To be precise the answer to this question is simply no.

With this your business is not allowed to deduct political contributions on its tax return. Are Donations Tax Deductible. Advertisements in a political convention program or politically affiliated.

A deduction for a contribution to a Canadian organization is not allowed if the contributor reports no taxable income from Canadian sources on the United States income tax. Political contributions deductible status is a myth. In comparison those sent by individuals or businesses to non.

Funds given to charity are tax-deductible unlike political contributions. When election season rolls around it can seem like news and. In a nutshell the quick answer to the question are political contributions.

Generally speaking only contributions made to certain tax-exempt organizations. Note that even though political donations are not tax deductible the IRS still limits how much money you can contribute for political purposes. That includes donations to.

Deductible contributions only apply to charitable organizations but political parties do not qualify for this designation. Even though charitable donations can be deductible from your tax. These limits apply to all contributions except contributions from a candidates personal funding.

Political donations are not tax-deductible but contributions to churches mosques temples or other religious groups are taxed. No political contributions are not tax-deductible for businesses either. This contribution is eligible for deduction while computing the total income of.

You cannot claim political deductions on your tax return for your business.

Tax Deductions Lower Taxes And Tax Liability Higher Refund

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible Anedot

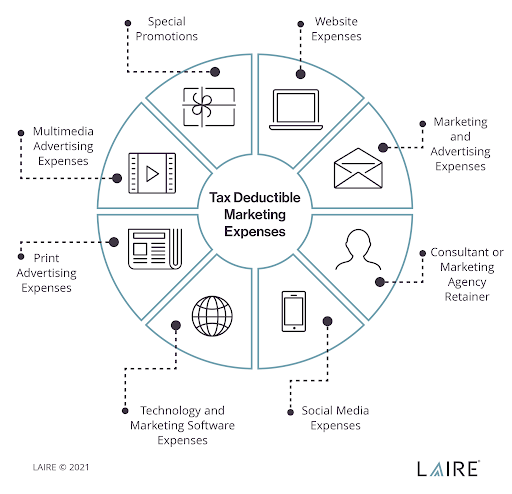

Write Off Your Marketing Expenses And Save Money On Your Taxes

Which Charitable Contributions Are Tax Deductible Infographic Turbotax Tax Tips Videos

What Are Business Tax Write Offs How Do They Work Paychex

17 Big Tax Deductions Write Offs For Businesses Bench Accounting

Why Political Contributions Are Not Tax Deductible

In Kind Donations And Tax Deductions 101 Donationmatch Donationmatch

Are Political Donations Tax Deductible Credit Karma

What Are Business Expenses Deductible Non Deductible Costs

Are Political Donations Tax Deductible Picnic Tax

Small Business Tax Deductible Charitable Donations Human Interest

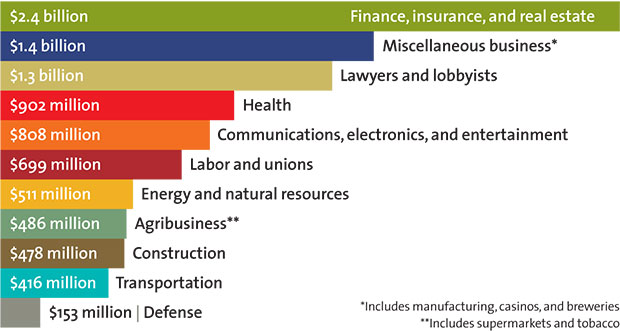

Capitol Hill S Top 75 Corporate Sponsors Mother Jones

Are Political Contributions Or Donations Tax Deductible The Turbotax Blog

The Ultimate List Of Tax Deductions For Shop Owners In 2020 Gusto

In Kind Donations And Tax Deductions 101 Donationmatch Donationmatch